Freedom Account

Safe and simple for your everyday banking.

An account designed for you.

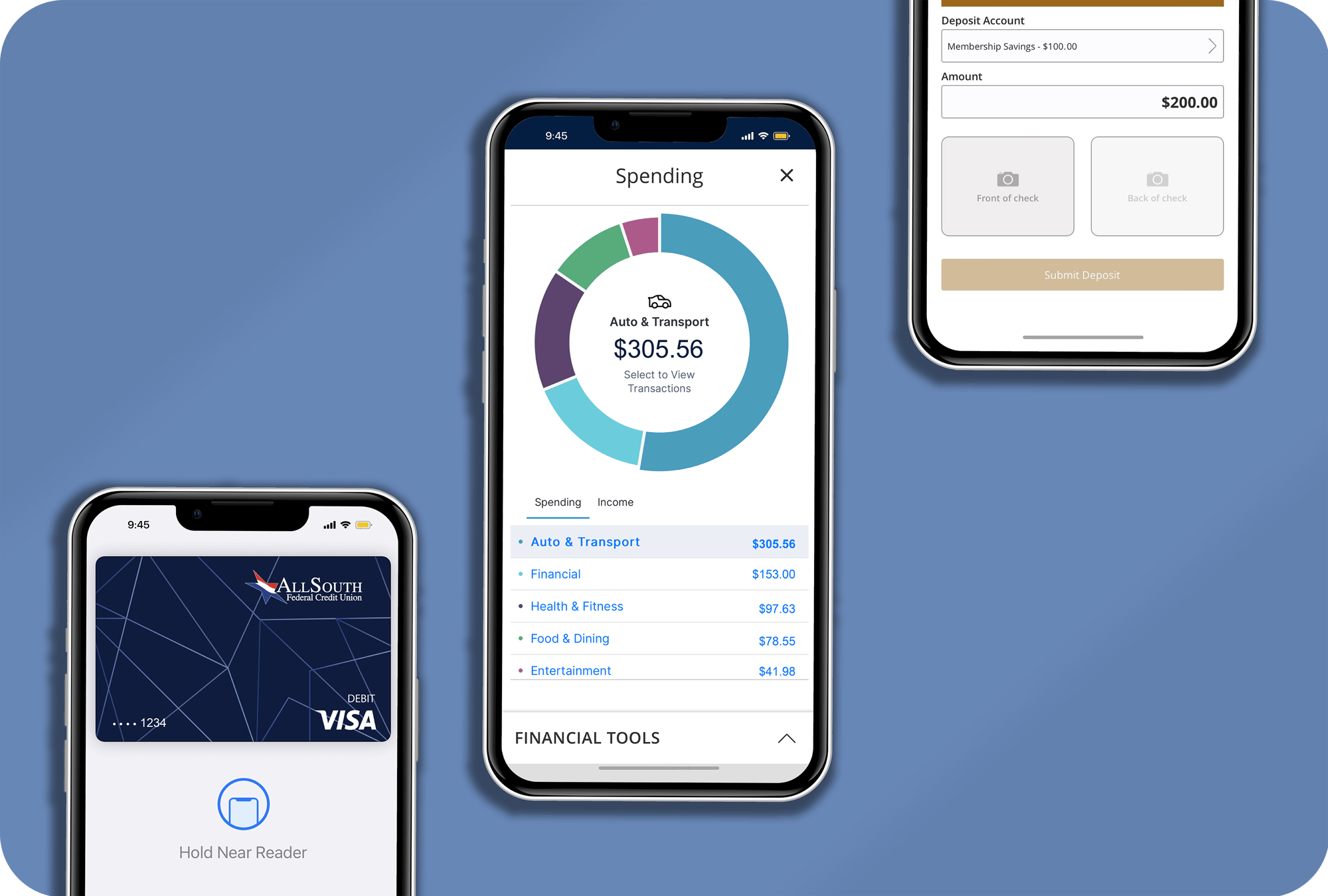

Categorize Your Spending

Keep track of your purchases, create budgets, and analyze your spending.

Connect Your Accounts

See your money in one place by connecting your accounts at other financial institutions.

Send with Zelle®

A fast, safe, and free2 way to send money to friends and family.

Access 30,000+ ATMs

Access your cash surcharge-free from over 30,000 ATMs around the country.

Get Paid Early.

Cha-ching. Get paid up to one day earlier than your employer's payday when you setup direct deposit to your Freedom Account.3

No funds? No problem.

Life happens. We've got you. Overdraft options are available to help when you don't have enough funds in your account to cover your purchase.4 Overdraft Services fees may apply. We aim to be transparent, check out more information about our fees on our Fee Schedule.

Tap to Pay.

Gone are the days of inserting your debit card and holding up the line. Just tap to pay with your contactless card. Plus, you can add your card to your phone's Mobile Wallet.

Take us everywhere.

Manage your money wherever you go, with access to a wide range of digital services that enhance your banking experience.

Whether you're making your everyday purchases or planning your next big trip, our Freedom Account provides the tools and flexibility you need.

You're safe with us.

Set up daily balance updates and alerts.

Set up daily balance updates and alerts.

24/7 debit card fraud protection.

24/7 debit card fraud protection.

Your money is Federally Insured by the NCUA for up to $250,000.

Your money is Federally Insured by the NCUA for up to $250,000.

What everyone else is saying...

I love the App I don't have to call or go to the bank to track my activity I can just pull up the App and everything is at my fingertips thanks AllSouth.

- App User (2025)

Satisfied in all departments. Customer service is excellent. Tools and online access is spectacular.

- App User (2025)

AllSouth has always protected my account, and reps are very cordial, getting to the root of answering my questions and offering their best advice in any bank related issue.

- Angela I. (2025)

FAQs

Why AllSouth?

When you join AllSouth, you’ll get personal attention from dedicated team members, accounts with simple features to help you get your banking done, loan options to help you purchase a new car or home, and so much more. As a credit union, we’re member-owned. This means our members are our priority and we’re here to help you reach your financial goals. We invite you to join our growing family today.

What will I need to open an account online?

- Be 18 years of age or older

- Social Security Number or Individual Taxpayer Identification Number

- U.S. Government or State Issued ID

- Contact information, such as address and phone number

- If you want another person on your account as a joint member, they will need to submit their information too.

Is my money secure with AllSouth?

AllSouth Federal Credit Union is federally insured by the National Credit Union Administration (NCUA), an agency of the federal government. All deposit accounts are insured up to $250,000 per credit union member. We make it a priority to keep your personal information safe and secure. Remember, the best way to keep your money secure at any financial institution is to be aware of the current types of scams to look out for.

1 All other fees apply.

2 Mobile network carrier fees may apply. Zelle® and the Zelle® related marks are wholly owned by Early Warning Services, LLC and are used herein under license.

3 Direct Deposit and earlier availability of funds are subject to the timing of the payer’s funding. Early access to funds is based on a comparison of traditional banking policies and deposit of paper checks from employers and government agencies versus deposits made electronically.

4 Charges for each overdraft presented against your account do not obligate AllSouth to pay an overdraft, nor is AllSouth obligated to provide prior written notice of the decision to refuse payment of an overdraft.

Federally Insured by NCUA.